Partisan Fincorp is a Mumbai based Capital advisory group which was formed in the early 2012, by highly qualified professionals having over more than 20 years of collective experience, with investment support from leading Banks,NBFC’s and groups of offshore corporates and individual high net worth investors.

Currently we are associated with over 27 NBFC’s,9 Banks and 2 Private Equity groups

Management and finance professional with more than 9 years of experience in the industry, Financial services and Private Equity sectors, and a Banker with more than 10+ years of experience in Credit, Mutual Funds, Private Finance and Merchant Banking.

Post initial screening, and discussions with the promoters and the management, and an in-principle clearance from the Advisory Board, a Term Sheet is issued, detailing various tentative covenants.

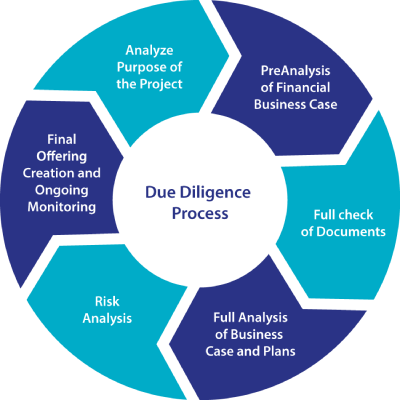

Post issuance of the Term Sheet and its execution with the Promoters, a due-diligence process is initiated, through independent agencies to cover the following areas: